Excel Expenses Claim Form Template UK – VAT MileageĪs set by HMRC, the standard mileage allowance you can claim for business travel is 45p per mile for the first 10,000 miles and then 25p per mile after that. Each expense will need a separate line if you have a receipt to claim with several different expenses then you will need a line for each type. The expense claim form templates are created to calculate all the figures for you this is especially useful for a VAT-registered business.Ĭomplete the section on the top right, including name, date and, if needed, authorisation signature. To track business expenses, download the correct template below, depending on whether you are registered for VAT.

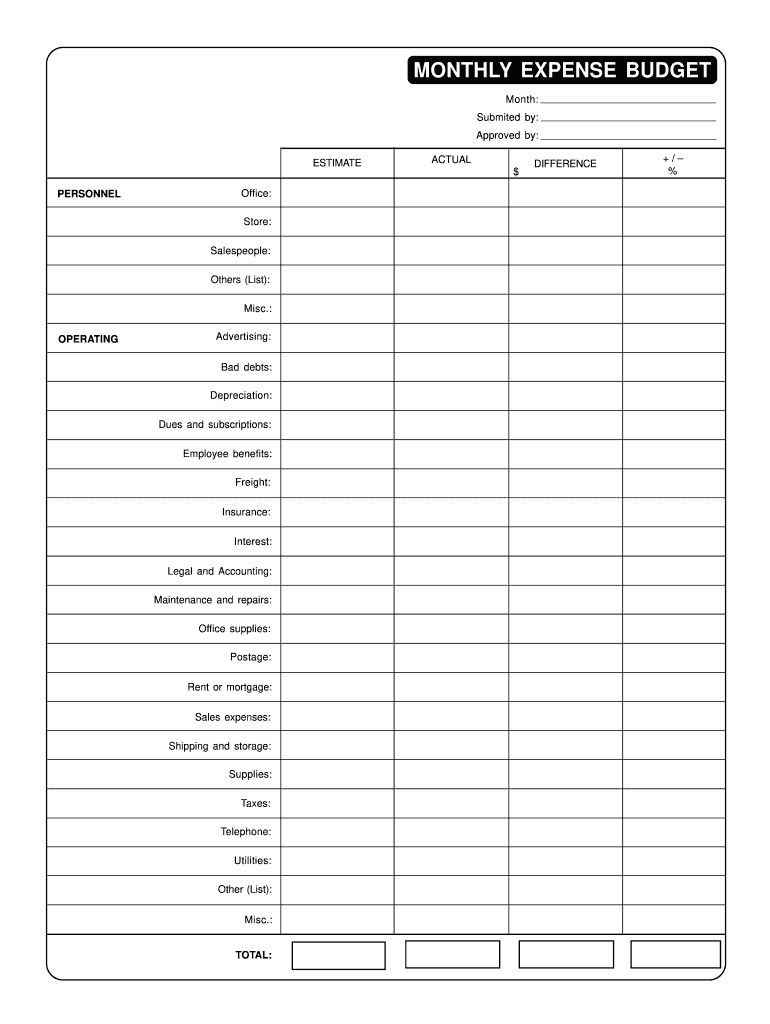

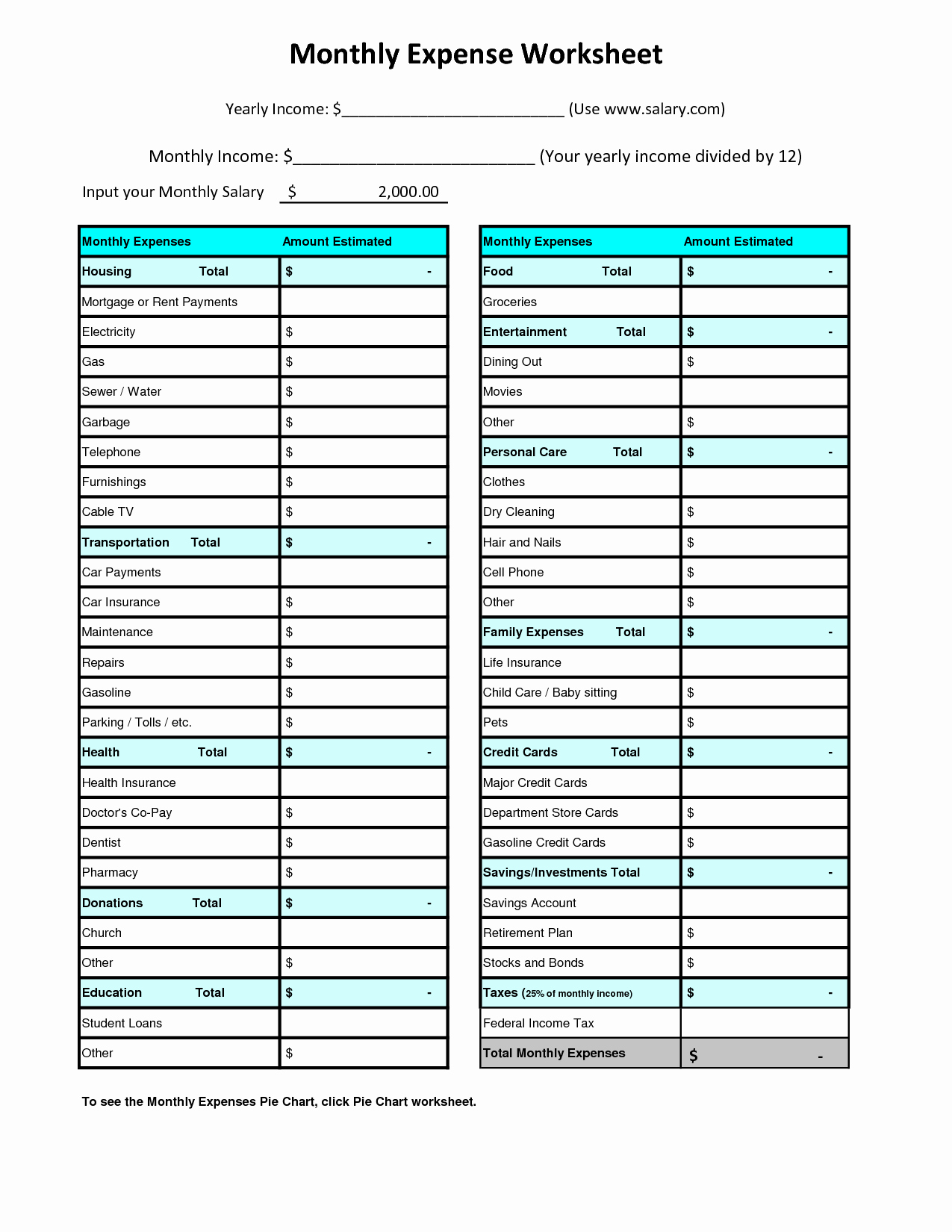

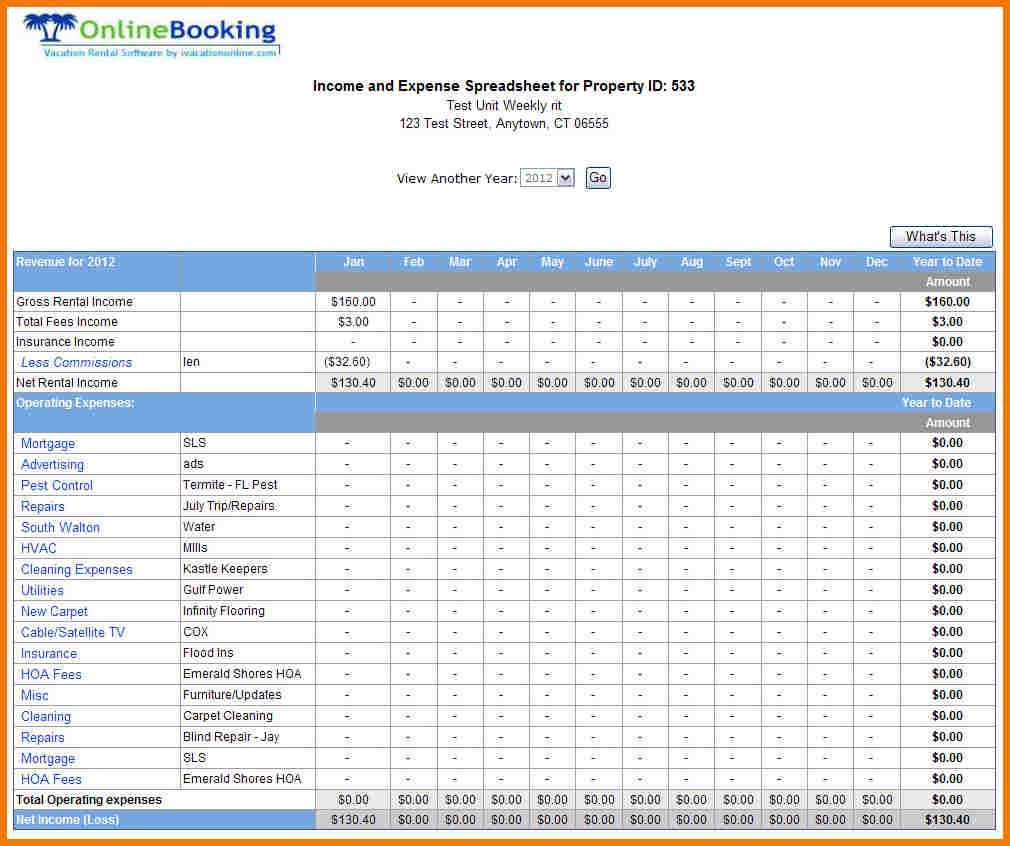

Once the template is complete, payment can be authorised to the employee and recorded in the accounting software.Įxpense Management Software Instructions for Small Business Monthly Expense Templateįollow the basic steps below to complete the expense claim form spreadsheet. There is a section for approval by a manager. Our Free Excel Expense claim form template will allow employees to record their mileage, subsistence, and other general office expenses. For example, it can be used to track actual expenses, including mileage, general office supplies and travel expenses. These procedures might include getting expenses authorised by a line manager, submission dates, and payment dates.Įxcel is a powerful tool that can help businesses keep track of their expenses. Most small business owners will have rules for claiming monthly expenses and typically have procedures for claiming the company’s expenses. We have a section on claiming business expenses, which is an excellent place to start if you are unsure what expenses to claim.

The expense sheet can be used in Microsoft Excel, Google Sheets or other spreadsheet apps. The first is for VAT-registered businesses it will calculate the VAT once the rate is entered.

0 kommentar(er)

0 kommentar(er)